FICA Tax: What It is and How to Calculate It

Por um escritor misterioso

Last updated 09 maio 2024

What is FICA tax? Learn what you need to know about this employee- and employer-paid federal tax that includes Social Security and Medicare.

What Is FICA Tax? A Guide to FICA Taxes for Business Owners (2023)

Overview of FICA Tax- Medicare & Social Security

Assume a tax rate of 6.2% on $128,400 for Social Security and 1.45

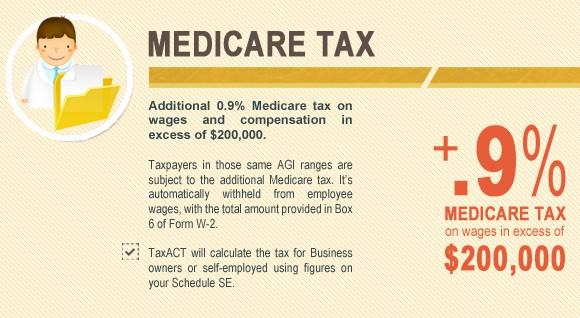

ACA Tax Law Changes for Higher Income Taxpayers

How To Calculate Payroll Taxes? FUTA, SUI and more

FICA Tax & Who Pays It

TX302: Payroll Withholding Tax Essentials

FICA Tax Exemption for Nonresident Aliens Explained

Federal Insurance Contributions Act - Wikipedia

What Maximum Social Security Tax Is

What is FICA Tax? - Optima Tax Relief

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet

:max_bytes(150000):strip_icc()/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated?

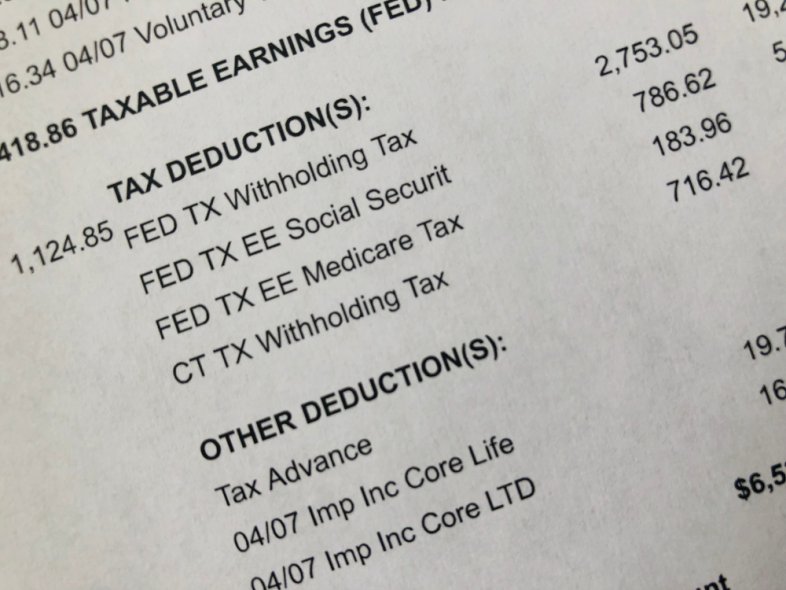

What Are the FICA Taxes on Every Payroll Check?

Recomendado para você

-

What are FICA Taxes? 2022-2023 Rates and Instructions09 maio 2024

-

FICA Tax Exemption for Nonresident Aliens Explained09 maio 2024

FICA Tax Exemption for Nonresident Aliens Explained09 maio 2024 -

FICA Tax Refund Timeline - About 6 Months with Employer Letter and Required Documents09 maio 2024

FICA Tax Refund Timeline - About 6 Months with Employer Letter and Required Documents09 maio 2024 -

What Are FICA Taxes And Do They Affect Me?, by M. De Oto09 maio 2024

What Are FICA Taxes And Do They Affect Me?, by M. De Oto09 maio 2024 -

Solved 2016 FICA Tax Rates 1 1 FICA taxes include Social09 maio 2024

-

FICA explained: Social Security and Medicare tax rates to know in 202309 maio 2024

FICA explained: Social Security and Medicare tax rates to know in 202309 maio 2024 -

How Do I Get a FICA Tax Refund for F1 Students?09 maio 2024

How Do I Get a FICA Tax Refund for F1 Students?09 maio 2024 -

How to get your FICA tax REFUND?, Form 843 & Form 8316, F1 Student, International Student09 maio 2024

How to get your FICA tax REFUND?, Form 843 & Form 8316, F1 Student, International Student09 maio 2024 -

Paychex on X: With the possibility of FICA tax rates fluctuating each year, it's essential to stay informed. Discover everything you need to know about these taxes and how to calculate them.09 maio 2024

Paychex on X: With the possibility of FICA tax rates fluctuating each year, it's essential to stay informed. Discover everything you need to know about these taxes and how to calculate them.09 maio 2024 -

How to FICA Tax and Tax Withholding Work in 2021-2022 - Reconcile Books09 maio 2024

How to FICA Tax and Tax Withholding Work in 2021-2022 - Reconcile Books09 maio 2024

você pode gostar

-

The Pawn's Revenge (Introduction) - EVY - Webtoons - Lezhin Comics09 maio 2024

The Pawn's Revenge (Introduction) - EVY - Webtoons - Lezhin Comics09 maio 2024 -

Play NBA 2K24 Through the Weekend with Xbox Live Free Play Days09 maio 2024

Play NBA 2K24 Through the Weekend with Xbox Live Free Play Days09 maio 2024 -

The History of Teia.art - how Hic Et Nunc was Reborn09 maio 2024

The History of Teia.art - how Hic Et Nunc was Reborn09 maio 2024 -

Stream Summertime Rendering ED2 - Shitsuren Song by Riria.(Katzhu09 maio 2024

Stream Summertime Rendering ED2 - Shitsuren Song by Riria.(Katzhu09 maio 2024 -

Why is Fallon Sherrock playing at the PDC World Darts Championship09 maio 2024

Why is Fallon Sherrock playing at the PDC World Darts Championship09 maio 2024 -

Jogo Mega Construções 45 Peças de Madeira Pais e Filhos09 maio 2024

Jogo Mega Construções 45 Peças de Madeira Pais e Filhos09 maio 2024 -

87b089fdce969b20c5d8f8bfc2eb10b29b402940.png09 maio 2024

87b089fdce969b20c5d8f8bfc2eb10b29b402940.png09 maio 2024 -

Assistir Hametsu no Oukoku - Episódio 3 - AnimeFire09 maio 2024

Assistir Hametsu no Oukoku - Episódio 3 - AnimeFire09 maio 2024 -

Jogo de Carros Rebaixados Brasileiro com Multiplayer – Carros Rebaixados Online09 maio 2024

Jogo de Carros Rebaixados Brasileiro com Multiplayer – Carros Rebaixados Online09 maio 2024 -

Dungeon ni Deai wo Motomeru no wa Machigatteiru no Darou ka IV09 maio 2024

Dungeon ni Deai wo Motomeru no wa Machigatteiru no Darou ka IV09 maio 2024