Tie Breaker Rule in Tax Treaties

Por um escritor misterioso

Last updated 09 junho 2024

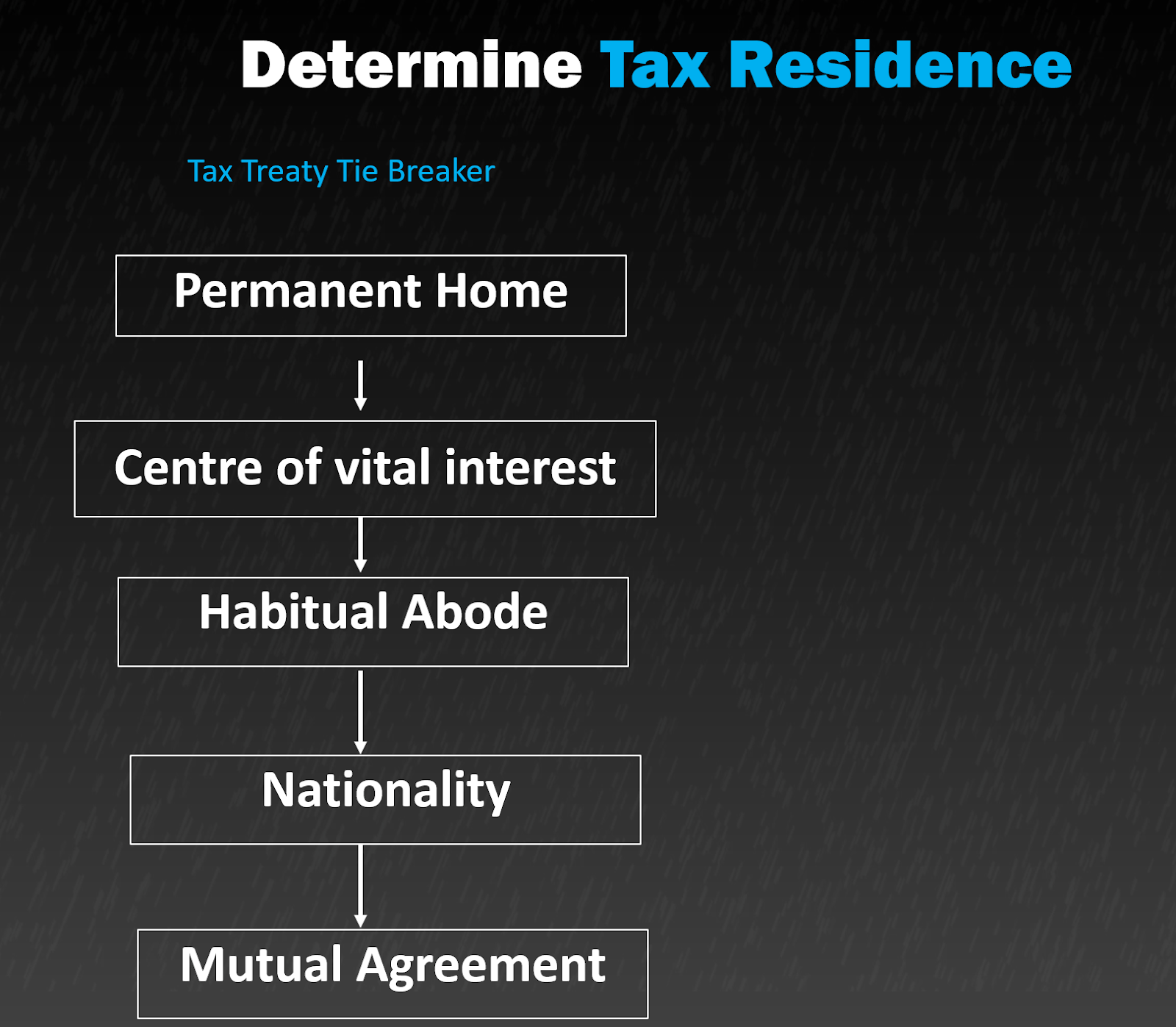

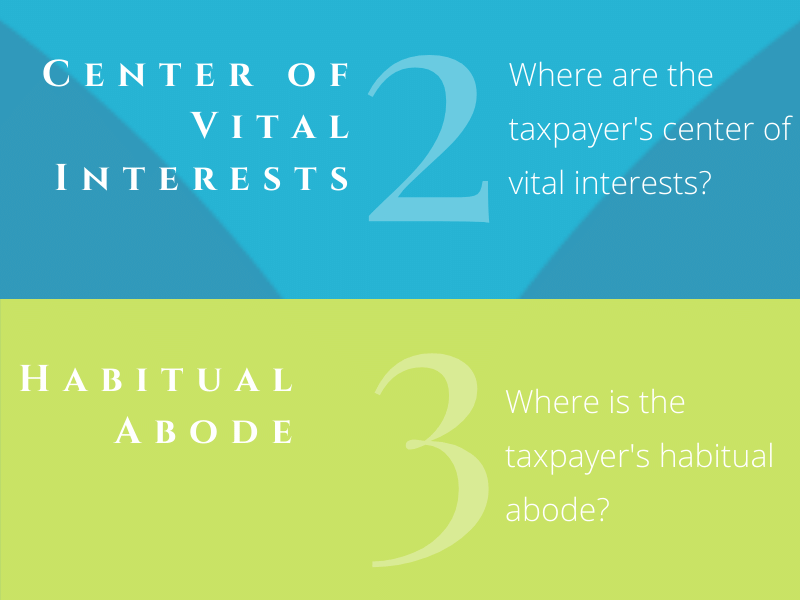

Hello Connections, Let’s briefly discuss the Tie Breaker Rule in Tax Treaties. Tie Breaker Rule are used when an individual becomes resident in both contracting states due to their domestic laws/rules, to determine the residential status of such individual for the purpose of taxability of income.

The Tax Times: LB&I Adds a Practice Unit Determining an Individual's Residency for Treaty Purposes

Non-US Citizens: How to Avoid Becoming a Tax Resident in the US

PDF) The application of 'Tie-breaker rules' for the Tax Residence of Individuals

How To Handle Dual Residents: IRS Tiebreakers

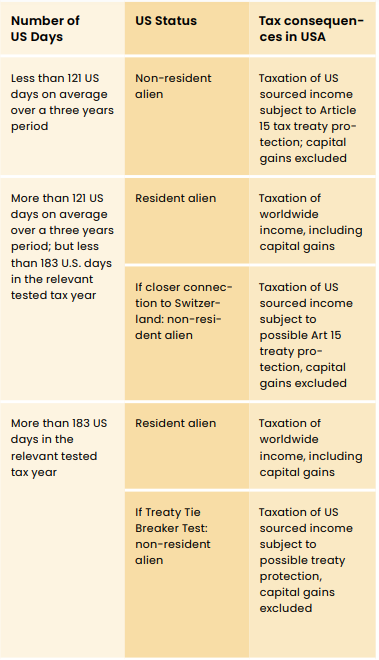

Expansion into the USA: dos and don'ts from a tax point of view - Lexology

Canadian Snowbirds and U.S. Income Tax

Residency Tie Breaker Rules & Relevance

Canada US Tax Treaty Residency Tie-Breaker Rules - US & Canadian Cross-Border Tax Service - Cross-Border Financial Professional Corporation

Article 4(2) - Tie breaker Rule in case of an individual - +91-9667714335

Tax considerations for Canadian snowbirds

Recomendado para você

-

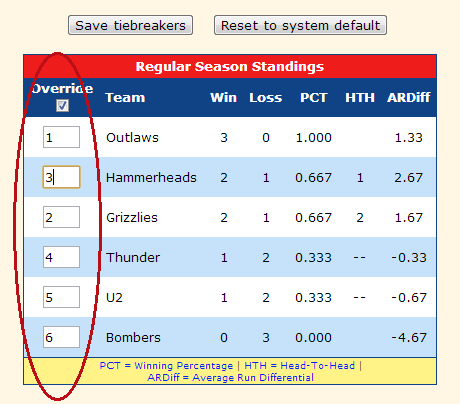

Regular Season Matchup Tiebreakers (LM Leagues) – ESPN Fan Support09 junho 2024

Regular Season Matchup Tiebreakers (LM Leagues) – ESPN Fan Support09 junho 2024 -

Tie Breakers, The Pub Quiz Bros09 junho 2024

Tie Breakers, The Pub Quiz Bros09 junho 2024 -

Tie-Breaker Help Guide09 junho 2024

Tie-Breaker Help Guide09 junho 2024 -

Tie Breaker09 junho 2024

-

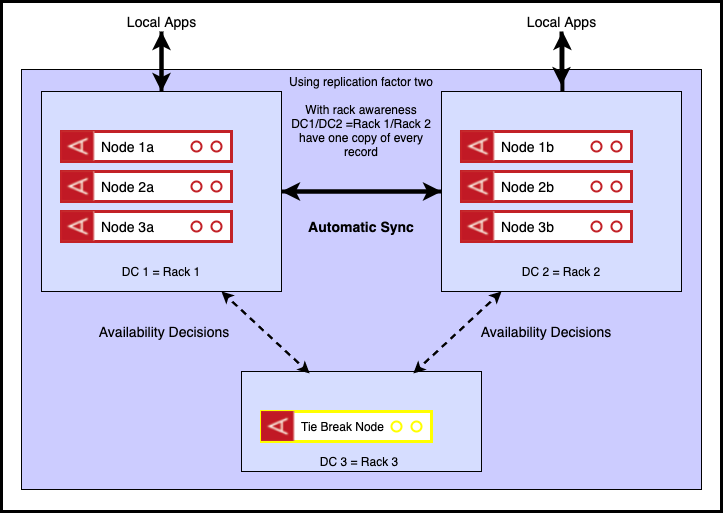

Tie Breaker Functionality for Aerospike Multi-Site Clustering09 junho 2024

Tie Breaker Functionality for Aerospike Multi-Site Clustering09 junho 2024 -

Break-Off Tools — Steel Dog09 junho 2024

Break-Off Tools — Steel Dog09 junho 2024 -

Stream Tie-Breaker - Friday Night Funkin' Corruption Takeover OST (LongestSoloEver) by Jeza09 junho 2024

Stream Tie-Breaker - Friday Night Funkin' Corruption Takeover OST (LongestSoloEver) by Jeza09 junho 2024 -

Tie Breaker - Apps on Google Play09 junho 2024

-

Tie Breaker Number Two - Baby Dodge Number Five! — Vox Clara Family09 junho 2024

Tie Breaker Number Two - Baby Dodge Number Five! — Vox Clara Family09 junho 2024 -

2009 American League Central tie-breaker game - Wikipedia09 junho 2024

2009 American League Central tie-breaker game - Wikipedia09 junho 2024

você pode gostar

-

SUBWAY CLASH 3D Juega Subway Clash 3D en Poki Google Chrome 202309 junho 2024

SUBWAY CLASH 3D Juega Subway Clash 3D en Poki Google Chrome 202309 junho 2024 -

Renan Souzones on X: Duvido vocês terem uma afilhada tão gângster quanto a minha. 💪🏻🔫 #naomeleves / X09 junho 2024

Renan Souzones on X: Duvido vocês terem uma afilhada tão gângster quanto a minha. 💪🏻🔫 #naomeleves / X09 junho 2024 -

Higurashi Sotsu - 03 - 32 - Lost in Anime09 junho 2024

Higurashi Sotsu - 03 - 32 - Lost in Anime09 junho 2024 -

The Fellowship of the Ring: Book I, Chapters I & II : The Last Alliance: University of Alberta Tolkien Society : Free Download, Borrow, and Streaming : Internet Archive09 junho 2024

The Fellowship of the Ring: Book I, Chapters I & II : The Last Alliance: University of Alberta Tolkien Society : Free Download, Borrow, and Streaming : Internet Archive09 junho 2024 -

Assassins Creed Brotherhood - Jogo PS3 Mídia Física em Promoção na Americanas09 junho 2024

Assassins Creed Brotherhood - Jogo PS3 Mídia Física em Promoção na Americanas09 junho 2024 -

hacker prank simulator|TikTok Search09 junho 2024

-

Rome, Italy, 5th January, 2020. Roma fans show a banner during the Serie A soccer match between Roma and Torino at the Olympic Stadium. Credit Riccardo De Luca - UPDATE IMAGES /09 junho 2024

Rome, Italy, 5th January, 2020. Roma fans show a banner during the Serie A soccer match between Roma and Torino at the Olympic Stadium. Credit Riccardo De Luca - UPDATE IMAGES /09 junho 2024 -

GTA V Mobile NCC- APK para Android - Como é? Vale a pena Baixar09 junho 2024

GTA V Mobile NCC- APK para Android - Como é? Vale a pena Baixar09 junho 2024 -

ArtStation - Character Design and Animation - Evelyn, the Tech Merchant09 junho 2024

ArtStation - Character Design and Animation - Evelyn, the Tech Merchant09 junho 2024 -

PT/BR) BLEACH DUBLADO EPISODIO 115 on Make a GIF09 junho 2024

PT/BR) BLEACH DUBLADO EPISODIO 115 on Make a GIF09 junho 2024