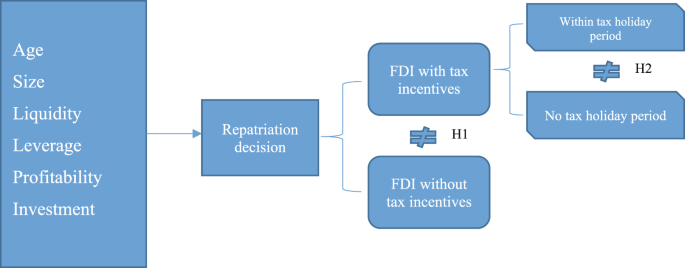

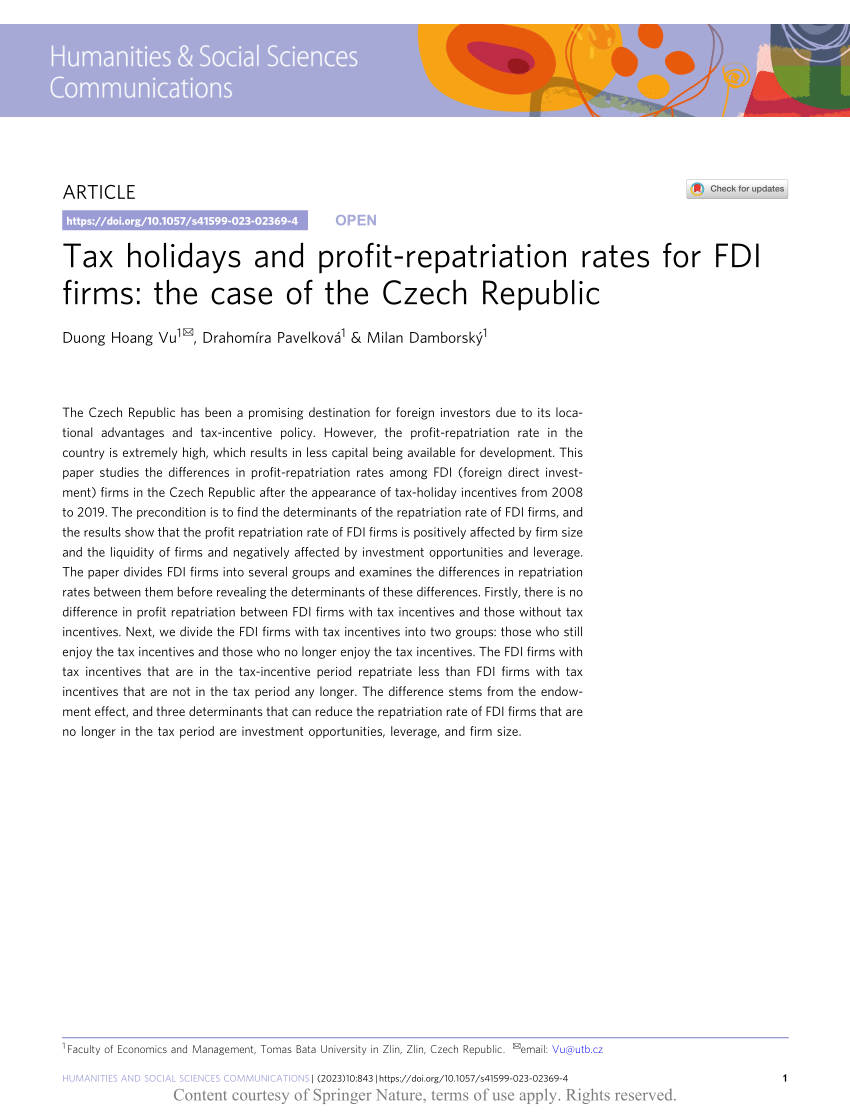

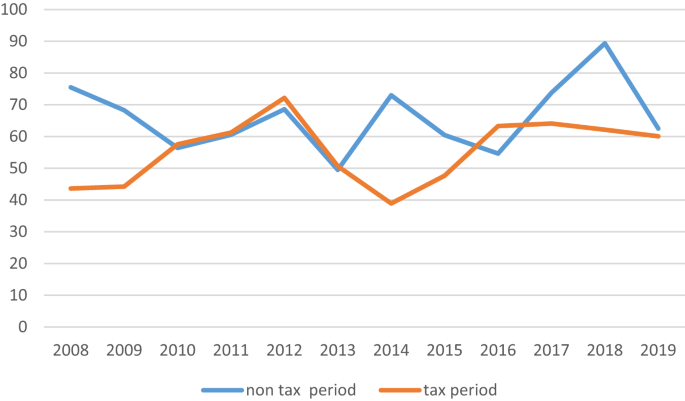

Tax holidays and profit-repatriation rates for FDI firms: the case of the Czech Republic

Por um escritor misterioso

Last updated 23 maio 2024

Page 10 – United States Department of State

Skilled Labor Force - FasterCapital

Full article: Observing FDI spillover transmission channels

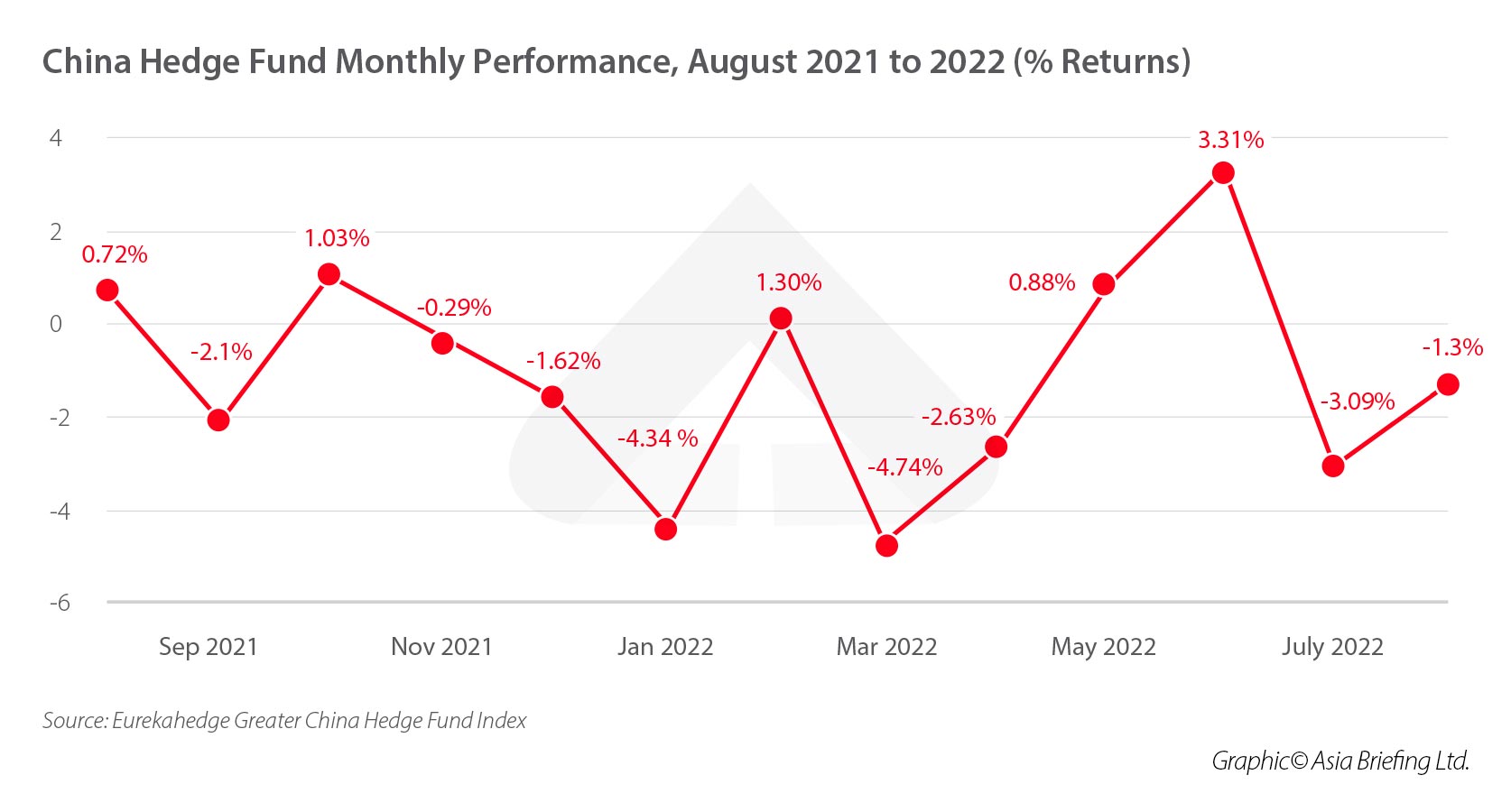

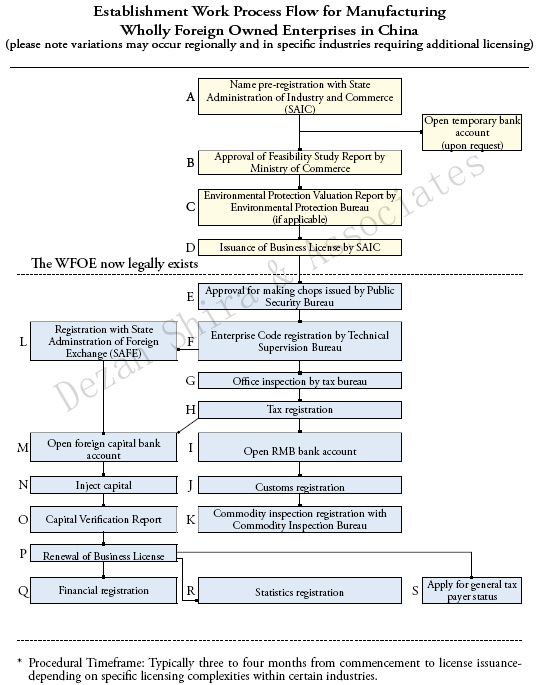

Foreign Investment in China - August 2022 Roundup and Policy

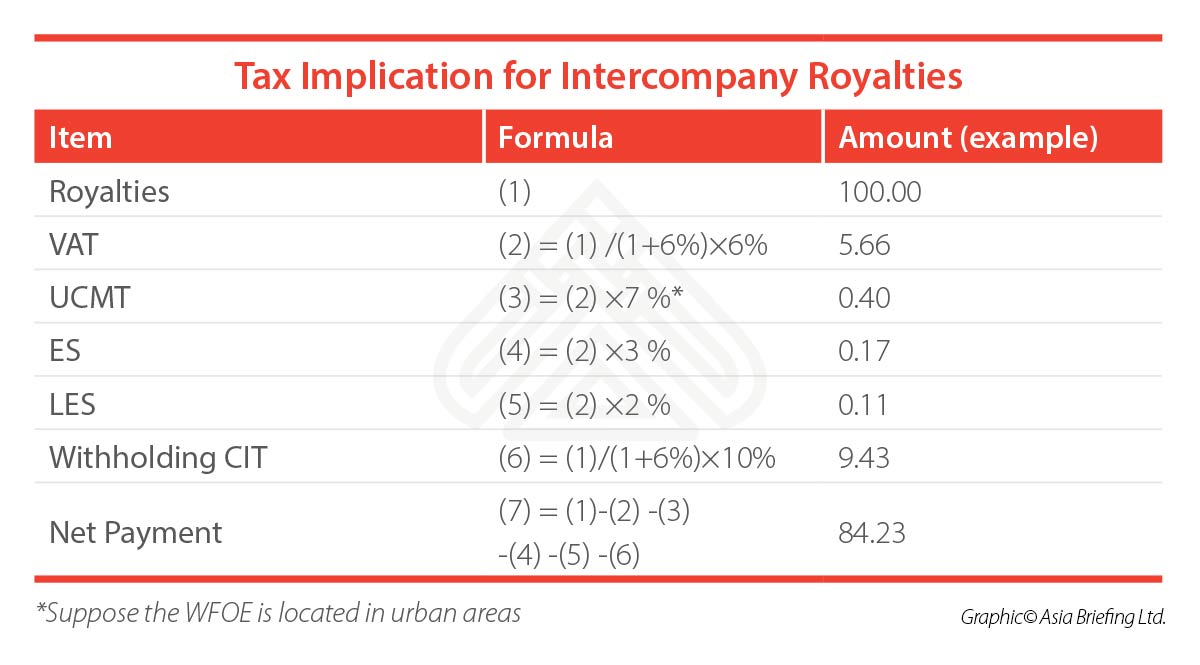

Profit Repatriation from China - China Briefing News

Foreign investments - FasterCapital

Whose success? The state–foreign capital nexus and the development

PDF) Tax holidays and profit-repatriation rates for FDI firms: the

Tax holidays and profit-repatriation rates for FDI firms: the case

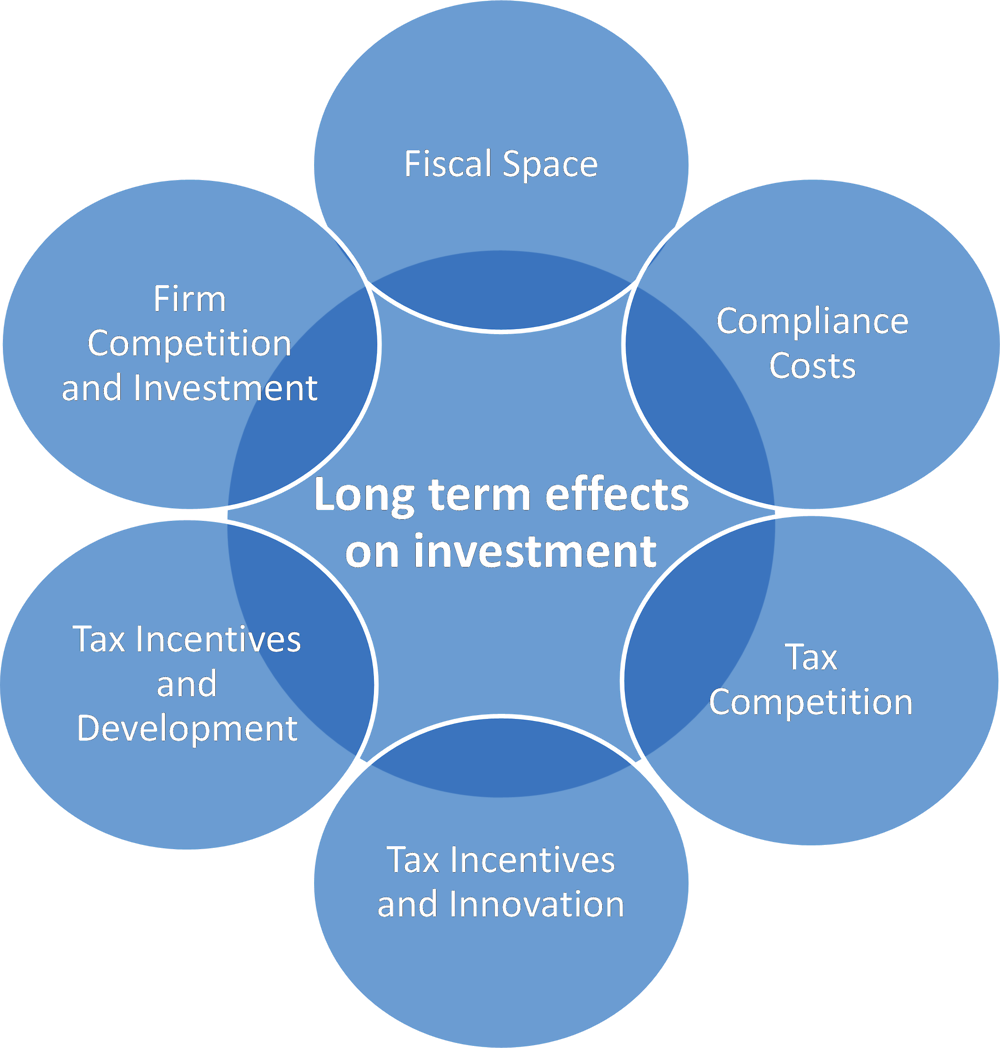

4. Investment Impacts of Pillar One and Pillar Two

PDF) A review of Tax Incentives and its impact on Foreign Direct

China Incorporations. Let's Get Real: They are a Tax-Based, not

Recomendado para você

-

Time Control Contabilidade - Time Control Contabilidade23 maio 2024

-

.jpeg) Vaga Assistente de RH em Fortaleza/Ce23 maio 2024

Vaga Assistente de RH em Fortaleza/Ce23 maio 2024 -

God Control – Contabilidade em São Paulo23 maio 2024

God Control – Contabilidade em São Paulo23 maio 2024 -

Digital Leaders Spotlight: Portal Mais Transparência, Portugal23 maio 2024

Digital Leaders Spotlight: Portal Mais Transparência, Portugal23 maio 2024 -

Fevereiro - mês de aniversário da Trino Soluções Contábeis23 maio 2024

Fevereiro - mês de aniversário da Trino Soluções Contábeis23 maio 2024 -

Produção Bibliométrica em Contabilidade by Editora Universitária da UERN - EDUERN - Issuu23 maio 2024

Produção Bibliométrica em Contabilidade by Editora Universitária da UERN - EDUERN - Issuu23 maio 2024 -

Novidade no Integra Contador ajuda empresas a ficarem em dia com o Fisco23 maio 2024

-

Orcamento dominar o planejamento financeiro com controle estrategico de contabilidade - FasterCapital23 maio 2024

Orcamento dominar o planejamento financeiro com controle estrategico de contabilidade - FasterCapital23 maio 2024 -

Inventory Management Software - Quickbooks23 maio 2024

Inventory Management Software - Quickbooks23 maio 2024 -

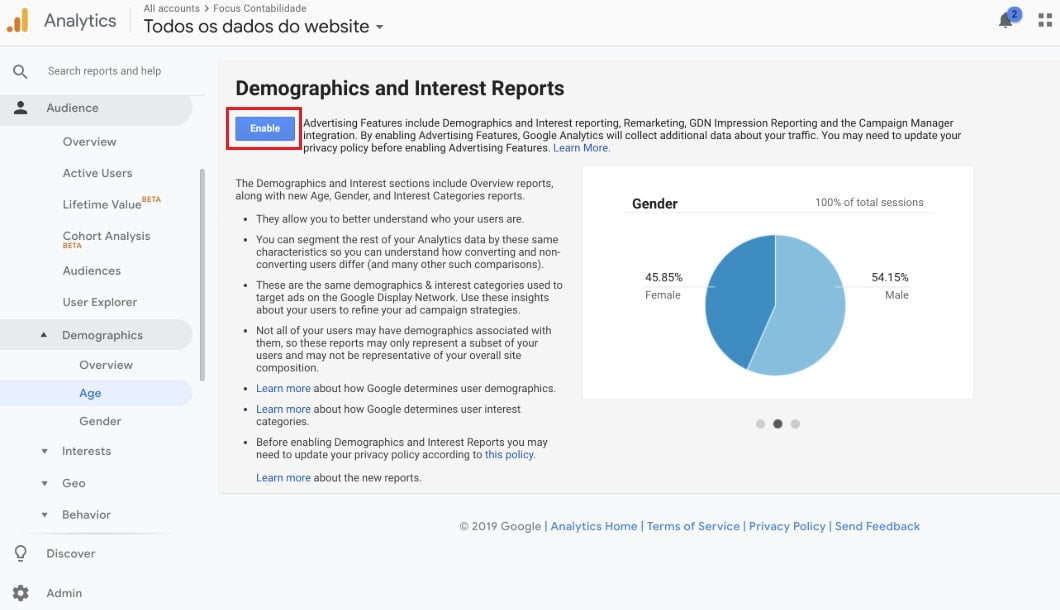

The Google Analytics graphs does not appear. What should I do? - Reportei23 maio 2024

The Google Analytics graphs does not appear. What should I do? - Reportei23 maio 2024

você pode gostar

-

Yu Yu Hakusho Botan Mascot 5 Figure Coin Bank JAPAN ANIME MANGA23 maio 2024

Yu Yu Hakusho Botan Mascot 5 Figure Coin Bank JAPAN ANIME MANGA23 maio 2024 -

Happy Mixed Race Couple Relax On Couch In Living Room Watch Movie23 maio 2024

Happy Mixed Race Couple Relax On Couch In Living Room Watch Movie23 maio 2024 -

Mythic Bestiary - Indian Gold-digging Ant by Boverisuchus on23 maio 2024

Mythic Bestiary - Indian Gold-digging Ant by Boverisuchus on23 maio 2024 -

Os Onis de Demon Slayer - Todas as Luas Superiores de Kimetsu no23 maio 2024

Os Onis de Demon Slayer - Todas as Luas Superiores de Kimetsu no23 maio 2024 -

2023 IHF World Men's Handball Championship: Results, scores and points tables23 maio 2024

-

HotS tier list ranking: number of & quality of skins : r23 maio 2024

HotS tier list ranking: number of & quality of skins : r23 maio 2024 -

DRIVE ANIMES on X: Bungou Stray Dogs 1 (Drive) LINK: / X23 maio 2024

DRIVE ANIMES on X: Bungou Stray Dogs 1 (Drive) LINK: / X23 maio 2024 -

Jogo de Estratégia - Duelo Spider Man - Homem Aranha - 0223 maio 2024

Jogo de Estratégia - Duelo Spider Man - Homem Aranha - 0223 maio 2024 -

Pokemon Mewtwo Strikes Back-Mewtwo by GiuseppeDiRosso on DeviantArt23 maio 2024

Pokemon Mewtwo Strikes Back-Mewtwo by GiuseppeDiRosso on DeviantArt23 maio 2024 -

Futebol ao vivo na tv hoje23 maio 2024

Futebol ao vivo na tv hoje23 maio 2024