How previous home sales might affect your capital gains taxes - Los Angeles Times

Por um escritor misterioso

Last updated 08 junho 2024

Rules on home sale gains changed in 1997. But there's a chance that a previous sale could alter how much you can defer now if you sell. Here's how.

Rules on home sale gains changed in 1997. But there's a chance that a previous sale could alter how much you can defer now if you sell. Here's how.

Rules on home sale gains changed in 1997. But there's a chance that a previous sale could alter how much you can defer now if you sell. Here's how.

Selling an Inherited House in California: Property Sale Tax & More

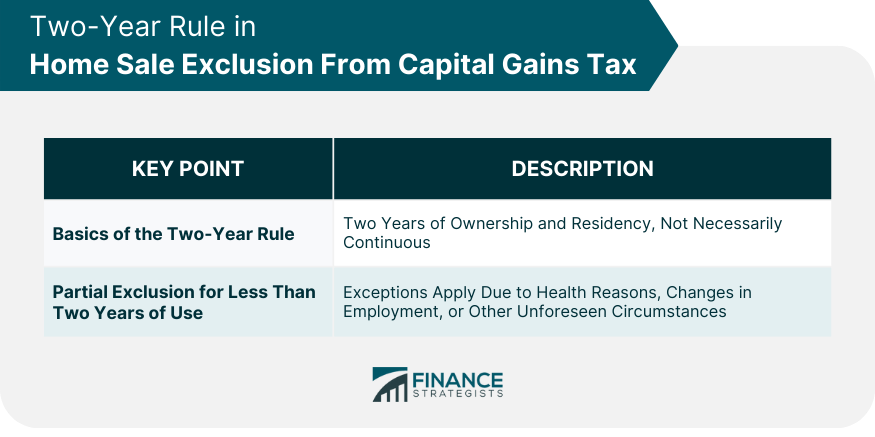

Home Sale Exclusion From Capital Gains Tax

IRS, California postpone tax deadline again for most in state - Los Angeles Times

Adjusted Annual Property Tax Bill Los Angeles County - Property Tax Portal

The Laws and Taxes When Selling a House in California - Chris Eckert Real Estate Team

How Proposition 19 Affects Inherited Property for Californians

Should I Sell My Home Now Or Wait?

Hiltzik: How the Supreme Court could block a wealth tax - Los Angeles Times

Will you have to pay taxes on California's gas rebate? - Los Angeles Times

Many not claiming California tax credits for foster youth - Los Angeles Times

Money for nothing: The Qualified Small Business Stock capital gains exclusion is a giveaway to wealthy investors, startup founders, and their employees - Equitable Growth

Recomendado para você

-

Which one is correct? Do you at home? Or Are you at home? - Quora08 junho 2024

-

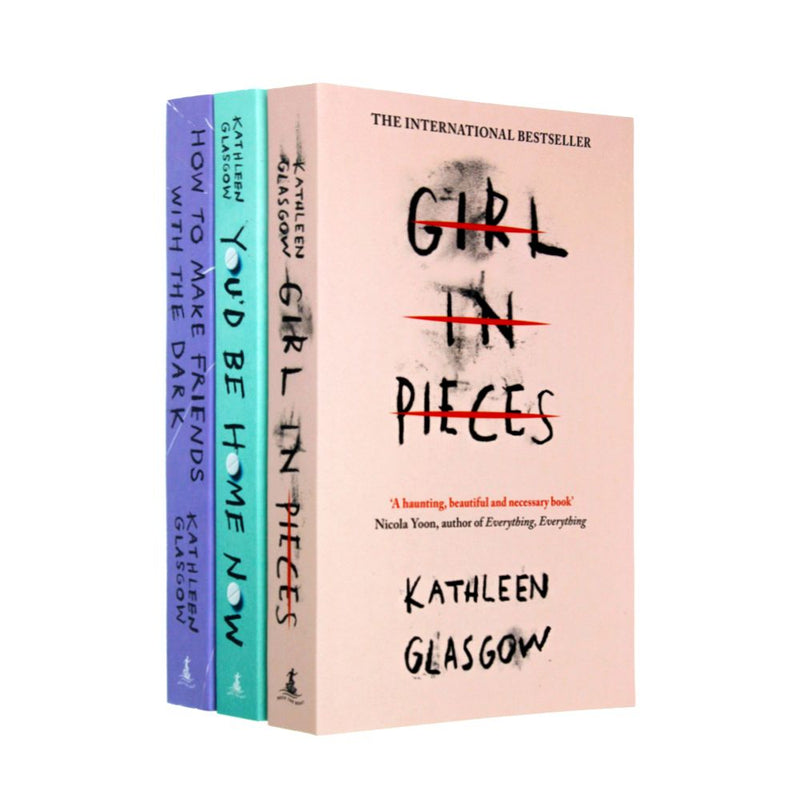

Kathleen Glasgow 3 Book Set Collection (You'd be home now, Girl in Pie – Lowplex08 junho 2024

Kathleen Glasgow 3 Book Set Collection (You'd be home now, Girl in Pie – Lowplex08 junho 2024 -

Is Now A Good Time To Buy A House?08 junho 2024

Is Now A Good Time To Buy A House?08 junho 2024 -

HOME with Dean Sharp, The House Whisperer08 junho 2024

-

BinaxNOW: What You Need to Know08 junho 2024

BinaxNOW: What You Need to Know08 junho 2024 -

Tour the L.A. house museum devoted to Modernist Paul McCobb - Los Angeles Times08 junho 2024

Tour the L.A. house museum devoted to Modernist Paul McCobb - Los Angeles Times08 junho 2024 -

6 Celebrity Homes You Can Rent Right Now: Prices, Location, Photos08 junho 2024

-

Cycology Studio – Ride Local08 junho 2024

Cycology Studio – Ride Local08 junho 2024 -

40 free + fun things to do at home - Positively Present - Dani DiPirro08 junho 2024

40 free + fun things to do at home - Positively Present - Dani DiPirro08 junho 2024 -

Ricky Bobby 'Talladega Nights' mansion for sale, Charlotte news08 junho 2024

Ricky Bobby 'Talladega Nights' mansion for sale, Charlotte news08 junho 2024

você pode gostar

-

The Rock's Eyebrow Raise (Meme)08 junho 2024

The Rock's Eyebrow Raise (Meme)08 junho 2024 -

Emma Louise - Jungle (Lyrics) My head is a jungle, jungle08 junho 2024

Emma Louise - Jungle (Lyrics) My head is a jungle, jungle08 junho 2024 -

Generic Plans For a New Blunder08 junho 2024

Generic Plans For a New Blunder08 junho 2024 -

Conoce a la Corporación a cargo de los Juegos Panamericanos 2023.08 junho 2024

-

This Metal Gear Rising Poster is hiding something - Metal Gear Informer08 junho 2024

This Metal Gear Rising Poster is hiding something - Metal Gear Informer08 junho 2024 -

Mera Mera no Mi, Wiki08 junho 2024

Mera Mera no Mi, Wiki08 junho 2024 -

Toy Freddy - Five Nights at Freddy's 2 - Fnaf - Magnet08 junho 2024

Toy Freddy - Five Nights at Freddy's 2 - Fnaf - Magnet08 junho 2024 -

Onde assistir jogo do Manchester City x Brighton e horário (20/04)08 junho 2024

Onde assistir jogo do Manchester City x Brighton e horário (20/04)08 junho 2024 -

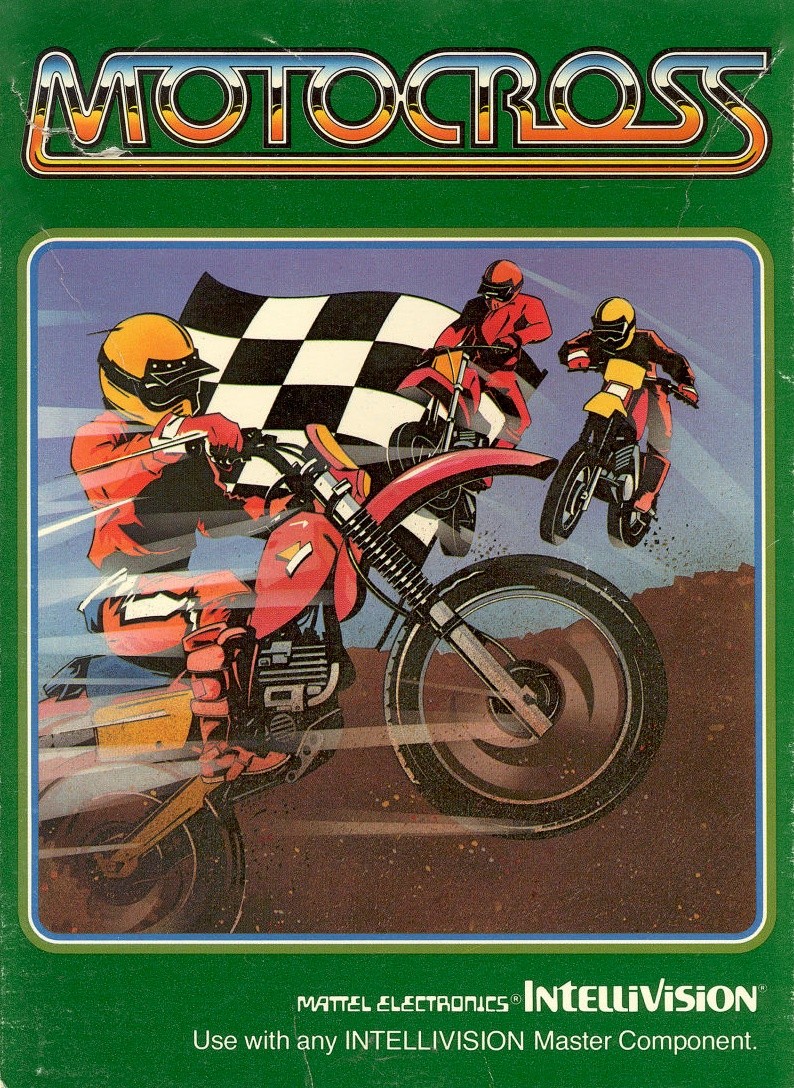

Motocross para Intellivision (1983)08 junho 2024

Motocross para Intellivision (1983)08 junho 2024 -

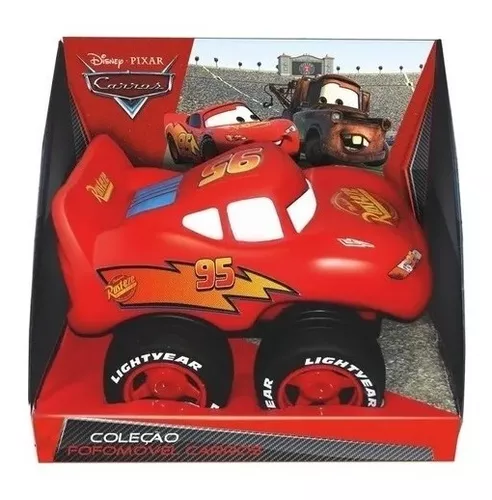

Fofomóvel Relâmpago Mcqueen Carros Brinquedo Corrida Disney08 junho 2024

Fofomóvel Relâmpago Mcqueen Carros Brinquedo Corrida Disney08 junho 2024